Conflicts: Macroeconomic Objectives - A-Level Economics

Current Macroeconomic Objectives

The government has six main macroeconomic objectives:

- Sustainable economic growth (actual growth)-‐ the government aim for growth to be continuous and as high as possible. Moreover, it is important for growth to be sustainable, which means growth without inflation. However, at times it is important to limit growth to protect the inflation rate and also the environment.

- Control of inflation-‐ the government aims to maintain a stable inflation rate. Too high an inflation rate can lead to redistribution of income and loss of international competitiveness, and it also discourages foreign investment (foreigners do not want to invest in a currency that is depreciating in value).

- Low unemployment-‐ unemployment has severe effects on the economy. Firstly, the economy is working within its PPF, so there is a wastage of scarce resources. These unemployed workers may even leave the labour market, which would result in an inward shift of the PPF curve. Secondly, the government bears a cost in terms of reduced income tax revenue and increased expenditure on benefits (JSA). There are also negative externalities associated with high unemployment, such as high crime rates and poverty.

- Equilibrium in Balance of Payments-‐ it is important to keep the current account in equilibrium.Most economies can finance a current account deficit by attracting enough foreign investment (leading to a financial account surplus). However, this is still a bad thing because these economies, despite being able to balance the deficit, are showing a lack of global competitiveness, which shows an underlying flaw in the manufacturing industry. Also, a deficit suggests that the economy may be overspending relative to its income, and at some point the outflow of money has to be compensated by inflows.The problem becomes worse for economies who are unable to attract enough foreign investment to balance the deficit. These economies are likely to struggle and the exchange rate will face downward pressure.A surplus in the current account may seem beneficial at first, but it means that the economy is sacrificing consumption within the economy for exports from abroad-‐ there is an outflow of goods from the economy, which may reduce quality of life within the economy.In this current era, the balance of payments is not considered very important by the UK government because there are huge capital inflows which make up for the deficit.However, in the long run economists agree that supply-‐side policies should be employed to increase global competitiveness.

- A more equal distribution of income— Often, governments achieve a more equal distribution by taxing the rich and giving to the poor through social expenditure’. However, many economists feel that over-‐taxing the rich is unfair because it destroys incentives and reduces work ethic. Moreover, social expenditure has little effect on reducing poverty-‐ some argue that it creates dependency (i.e. the poor become dependent on government support).The priority given to each of these six objectives depends on the political stance of the government. A socialist government may prioritise low unemployment and equal distribution of income, whilst another government might prioritise stable inflation rates.

Conflicts between Macroeconomic Objectives

Economic Growth and Low Inflation

If an economy grows too quickly, especially if it is due to excessive consumer spending as it tends to be in the UK, then demand will exceed supply and prices will rise.

Similarly, the policies undertaken to keep inflation low, such as high interest rates, can often restrict growth via reduced consumer spending and investment.

Therefore it is difficult to achieve both aims. The ‘trend’ rate of growth is seen as the rate of growth an economy can grow without greatly increasing the rate of inflation.

Economic growth and the balance of payments (current account)

As an economy grows, incomes rise and consumption increases. Therefore, consumers tend to purchase more imports, whilst firm’s incentive to export will fall (sales are rapid within the economy, so it is easier to concentrate on domestic sales). Exports will fall and import will rise, which will worsen the trade deficit of the balance of payments.

Evaluation 1: If the growth is export-‐led growth, the balance of payments will improve.

Evaluation 2: Economic growth tends to lead to a rise in investment within the economy, which leads to potential growth (an outward shift of the LRAS curve). This will make the economy more internationally competitive in terms of price and quality, which will mean that the economy can import less and export more while growing.

Evaluation 3: The exchange rate is likely to fall to correct the rise in the trade deficit. The fall in exchange rate makes imports dearer and exports cheaper, helping to fix the problem.

Inflation and employment

When the government tries to control high inflation with higher interest rates and reduced spending, the resulting reduced consumer spending and lower investment will result in job losses.

If the government tries to reduce unemployment (e.g. through lower interest rates or increased public spending), then the resulting reduction in unemployment will push wages higher (as employers try to attract workers from a diminishing pool of the unemployed).

This will lead to higher prices.

This can be summarised in seven steps:

- An increase in the demand for labour as government spending generates growth.

- The pool of unemployed people will fall.

- Firms must compete for fewer workers by raising nominal wages.

- Workers have greater bargaining power to seek out increases in nominal wages.

- Wage costs will rise.

- Faced with rising wage costs, firms pass on these cost increases in higher prices.

- However, in the long run, as inflation rises, newly employed workers will soon realize that their wages are being eroded by inflation, and firms will realize that they are not getting as much profit out of their workers because of inflation. Therefore any increase in employment is not likely to last in the long term.

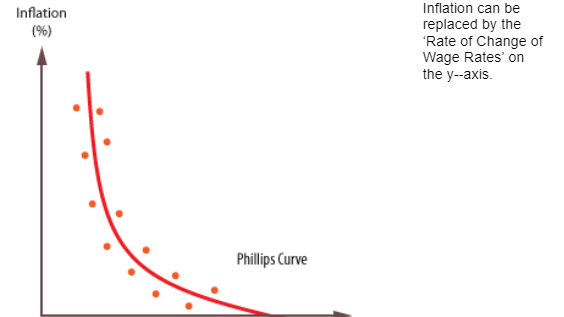

This relationship can be shown by the Phillips Curve:

The curve shows that there is a negative correlation between inflation (via wages) and unemployment.

Inflation and the balance of payments (current account)

When inflation is high, governments try to control inflation with high interest rates. High interest rates lead to high exchange rates (due to an influx in ‘hot money’), which makes imports cheaper and exports dearer-‐ the trade deficit worsens.

Evaluation: However, if inflation is very low, the government can reduce interest rates, which will reduce exchange rates and reduce the trade deficit.

Economic Growth and Income Distribution

Growth can lead to increased income inequality:

- Poorer, unskilled workers are less likely to benefit from economic growth. It is likely that the increased incomes go to the wealthier people in society, whilst unskilled workers are left behind.

- Economics growth can also lead to transitional change in the economy, which can lead to structural unemployment. Unskilled workers are more likely to be unemployed because they lack adequate skills to adapt to different jobs.

- Even if economic growth led to a constant percentage rise for all workers, income inequality will increase in absolute terms.

- Even if the economy grows, leading to a greater demand for labour, the gaps in the economy are likely to be filled by immigration, rather than low-‐skilled workers.

Evaluation: However, over time people at the top end of the economy may employ people from lower income groups. Increased demand for lower skilled labour should lead to increased wages. absolute poverty will decrease due to the ‘trickle down’ (wealthier people are earning more, so spend more, leading to more money passing to poor people, e.g. through government benefits).

Economic Growth and the Environment

Increased economic growth can have negative environmental effects:

- Increased congestion-‐ more workers being employed

- Increased production-‐ more pollution, more energy usage.

- Increased demand for natural resources (e.g. leading to depletion of fossil fuels)

- Increased demand for space for offices, factories etc., leading to deforestation

Evaluation:

- Higher employment may increase the ability of governments to charge higher taxes (e.g. green taxes)

- Economic growth tends to lead to greater efficiency

- Economic growth improves technology within the economy, which may increase the availability of clean technology

Still feel like you need some support? Why not contact our expert Macroeconomics tutors to see how we can support you in your studies!

Macroeconomic objectives refer to the goals that governments aim to achieve in order to improve the overall performance of the economy. The main macroeconomic objectives include economic growth, low inflation, low unemployment, and a stable balance of payments.

Conflicts arise between macroeconomic objectives because achieving one objective may come at the expense of another. For example, policies that stimulate economic growth may lead to higher inflation, while policies aimed at reducing inflation may lead to lower economic growth.

Conflicts between macroeconomic objectives can create trade-offs that may have both positive and negative effects on the economy. For example, policies that promote economic growth may lead to increased employment and higher incomes, but they may also lead to higher inflation and a worsening of the trade balance.

Some common conflicts between macroeconomic objectives include the trade-off between economic growth and inflation, the trade-off between unemployment and inflation, and the trade-off between the balance of payments and domestic economic objectives.

Governments can use a variety of policy tools to resolve conflicts between macroeconomic objectives. For example, they can use monetary policy to control inflation and fiscal policy to stimulate economic growth. However, finding the right balance between conflicting objectives can be difficult and requires careful analysis and decision-making.

The Phillips Curve is a graphical representation of the relationship between unemployment and inflation. The curve suggests that there is a trade-off between unemployment and inflation, with lower levels of unemployment leading to higher levels of inflation and vice versa.

The Phillips Curve highlights the trade-off between unemployment and inflation, which is a common conflict between macroeconomic objectives. Policymakers need to carefully balance the objectives of low unemployment and low inflation to ensure that the economy is operating at an optimal level.

It is unlikely that conflicts between macroeconomic objectives can be completely eliminated, as achieving one objective often comes at the expense of another. However, policymakers can use a variety of tools and strategies to minimize the negative effects of these trade-offs and find the best balance between conflicting objectives.

Understanding conflicts between macroeconomic objectives is important for A-Level students because it provides them with a deeper understanding of how the economy works and the trade-offs that policymakers face when making decisions. This knowledge can help students make informed decisions about their own economic behavior and prepare them for further study in economics or related fields.

Still got a question? Leave a comment

Leave a comment