Supply Side Policies - A-Level Economics

Supply Side Policies

Supply-‐side policies are policies to increase the quantity firms are willing to supply at any given price level. This can be achieved by an increase in the quantity and quality of resources in order to raise the productive capacity of an economy and shift out the LRAS curve.

These policies aim to:

- Improve competition and efficiency in product markets

- Improve competition and productivity in labour markets

- Provide incentives for firms to produce and invest

- Provide incentives for people to work

- Increase the geographical and occupational mobility of labour

Examples of Supply-‐Side Policies: Labour Market

Education and Training

How it Works

This policy involves encouraging provision of education and training. The government can achieve this in several ways-‐ for example they might subsidise firms to train their workers.

Improved Provision of Training and Education

- Increased opportunities and incentives for workers

- Increase in quality and productivity of workforce

- Increase in occupational mobility 🡪 fall in structural unemployment

Therefore there will be an improvement in quantity (supply) and quality (productivity) of labour-‐ the LRAS curve shifts outwards.

Evaluation

Time Lags

There will be time lags between initial investment and the benefits. For example, if the government invested in the building of a new university, it would take many years for it to be built.

Opportunity Cost of Government Spending

The government could have spent the money on healthcare, on reducing taxes or reducing borrowing.

Short Run vs. Long Run

In the SR, the supply of labour might fall as workers go into training. In the LR, there will be more skilled workers.

Subject Field

The effect of education will be very limited if it leads to an increase in people taking insignificant courses such as Surf Science.

Reduction in Income Tax

How it Works

Lower Rate of Income Tax

- Increased incentive to work because there is more disposable income available from working

- Increased opportunity cost of not working

- Increase in supply of labour

Evaluation

Wage Rate

The increase in supply of labour might decrease the wage rate, which has the opposite effect

Loss of Government Tax Revenue

There will be a reduction in tax revenue, so there may be less money to be spent in improving the productive capacity elsewhere in the economy (e.g. through improved education)

Availability of Jobs

There might not be enough jobs available to accommodate the increase in supply of labour, so there might be high unemployment levels

Top Tax Rate?

The effect depends on which tax rate is cut-‐ cutting the top tax rate will only affect a few wealthy people who are likely to already be in work. An increase in the lower tax rate will incentivise inactive people to seek a job.

Size of Tax Cut

The magnitude of the tax cut determines the extent of its effect.

Reduction in Corporation Tax

How it Works

Lower Rate of Corporation Tax

- Increase in retained profits for firms

- Investment increases

- Capital stock increases

- Increase in quantity/ quality of capital

Evaluation

Firms might Save

Firms might not invest, but save instead.

Mechanical Labour

Investment might lead to machinery replacing human labour, so there might be a fall in unemployment. This will not affect the shift in the AS curve, but it has negative effects for the economy

Size of Tax

The magnitude of the tax cut determines the extent of its effect. The cut has to be large compared to the costs of capital stock to encourage firms to invest.

Loss of Government Tax Revenue

There will be a reduction in tax revenue, so there may be less money to be spent in improving the productive capacity elsewhere in the economy (e.g. through improved education)

Time Lag

There will be a time lag between the tax cut, investment, and the increase in productive capacity

Reduction in Benefits, NMW, Trade Union Rights

How it Works

Lowering the benefits that unemployed people receive, will give people an incentive to work, increasing supply of labour. Moreover, all of these schemes provide a ‘safety-‐net’ to workers, but by removing these workers will be more willing to accept lower wages. This leads to a fall in production costs and also might lead to firms hiring more workers.

Evaluation

Fall in AD

The fall in government spending and consumption will lead to a fall in AD, exacerbated by the multiplier.

Availability of Jobs

There might not be enough jobs available to accommodate the increase in supply of labour, so there might be high unemployment levels

Necessary Skill Set

These unemployed people coming into the market might not have the necessary skill set required to work

Increasing Level of Inequality

The cut in benefits increases the gap between wealthier, employed people and poorer, unemployed people. Also, NMW, trade unions and benefits are all designed to help poorer people on lower incomes. By removing these people might suffer and slip into poverty.

Improved Information on Job Vacancies

How it Works

An increase in information about job vacancies will reduce frictional unemployment.

An increase in information about job vacancies around the country will increase geographical mobility.

Evaluation

Insignificant

Frictional unemployment is relatively small and insignificant.

General Evaluation

- Other policies might be more effective-‐ e.g. cutting interest rates

- The scope for further supply side policies is limited

- Supply-‐side policies involves cutting taxes and increasing government spending, which effectively means that the economy will be running an expansionary fiscal policy. This might conflict with what is best for the economy given its current fiscal position.

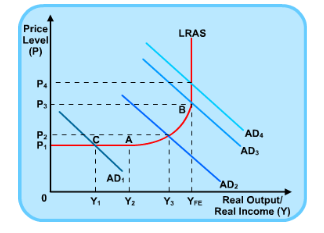

- If the AD in the economy is at point C in the diagram, a shift in the LRAS curve will have little effect. One could argue that investment should be concentrated on boosting AD instead of LRAS.

Examples of Supply-‐Side Policies: Product Market

There are many supply-‐side policies which aim to increase competition. Competition between firms means that firms have to either cut costs, improve quality of goods, or produce new goods in order to survive in the market. Moreover, competition reduces the possibility of a monopoly firm having power over the whole market. For example, monopoly firms can restrict output and raise price by using their power in the market.

Increasing competition reduces the power these firms have.

Privatisation

Privatisation is the selling of state-‐owned assets to the private sector.

The privatisation of various large former state-‐run industries (telecommunications, electricity, water, steel, gas, rail etc.) in the 1990s was designed to break up the state monopolies to create more competition.

Evaluation: Government ownership may be beneficial in circumstances where there is a high risk of market failure. Also, there is little scope left for privatization in the UK economy because privatization has already occurred greatly in the 1990s.

Deregulation

Deregulation involves removing government legislation in order to remove barriers to competition.

Deregulation limits government intervention in the market. This should lead to an increase in competition and hence a fall in prices, improvement in quality and an increase in innovation. Deregulation occurs when the government pulls back from the industry a bit, therefore loosening its grip on particular rules and regulations.

Every industry has government regulations that it must abide by. Regulations are often viewed as barriers for competitors looking to enter the market. Established firms within the market will oppose deregulation becomes it makes rules more relaxed for competitors.

The purpose of deregulation is to allow a particular industry to have greater competition, create a freer marketplace. When industries become deregulated it gives the firms in the market greater leeway in which to improve their products, craft their brand and, ultimately, appeal more to consumers

For example, deregulation in the phone industry has lead to improved standards in term of price levels and customer service. However, increased competition in other areas, such as the NHS, has just lead to increased management costs rather than improved efficiency.

Evaluation: Regulation may be beneficial in circumstances where there is a high risk of market failure.

Other Policies: Other policies include cutting bureaucracy, control of power of monopolies and reduction in planning restrictions

Supply side policies are government policies that aim to increase the productivity and efficiency of the economy by promoting incentives to work, invest, innovate, and produce. These policies focus on the supply side of the economy, aiming to increase the quantity and quality of goods and services produced.

Examples of supply side policies include reducing taxes on businesses and individuals, reducing regulation and bureaucracy, investing in education and training, promoting free trade, and encouraging research and development.

Supply side policies can increase economic growth by promoting productivity and efficiency. By reducing the costs of production and increasing incentives to work and invest, businesses can expand output and profits. This can lead to higher economic growth rates over the long term.

No, supply side policies are not a guaranteed way to achieve economic growth. The effectiveness of these policies depends on a number of factors, including the state of the economy, the type of policies implemented, and the level of competition in the market.

The advantages of supply side policies include increased productivity, efficiency, and economic growth. These policies can also lead to lower inflation, reduced unemployment, and improved standards of living.

The disadvantages of supply side policies include the potential for increased income inequality, the possibility of creating negative externalities such as environmental degradation, and the risk of reducing government revenue through tax cuts.

Supply side policies can have a positive impact on inflation by reducing the costs of production and increasing productivity. This can lead to lower prices for goods and services, which can help to reduce inflationary pressures in the economy.

Supply side policies can have a positive impact on unemployment by increasing incentives to work and invest. By reducing the costs of production and promoting job creation, businesses can expand output and employment opportunities, which can lead to lower unemployment rates over the long term.

The role of government in implementing supply side policies is to create a favorable business environment that promotes incentives to work, invest, innovate, and produce. This can be done through tax cuts, deregulation, education and training programs, and infrastructure investments, among other measures.

Supply side policies can have a positive impact on international trade by promoting free trade and reducing barriers to entry for businesses. By increasing productivity and efficiency, businesses can become more competitive in the global market, which can lead to increased exports and foreign investment.

Still got a question? Leave a comment

Leave a comment