Aggregate Demand - A-Level Economics

Aggregate Demand

What is Aggregate Demand?

Demand is the quantity purchased at any given price.

Aggregate means ‘added together’.

We can total all of the demand or expenditure in an economy at any given price level to give a value called the aggregate demand.

Aggregate Demand is defined as the total planned expenditure on goods and services produced in an economy.

To find all of the total expenditure in the economy, we have to consider:

- Consumption-‐ spending by households

- Investment-‐ spending by firms on capital stock

- Government Spending-‐ spending by governments

- Imports-‐ spending by residents on goods abroad (negative)

- Exports-‐ spending by foreigners on the economy’s goods (positive)

AD = C + I + G + (X – M)

| Component | % of GDP in UK |

|---|---|

| Consumption (C) | 65% |

| Investment (I) | 18% |

| Government spending (G) | 21% |

| Exports (X) | 29% |

| Imports (M) | – 33% |

Each component has a different importance in the calculation of AD.

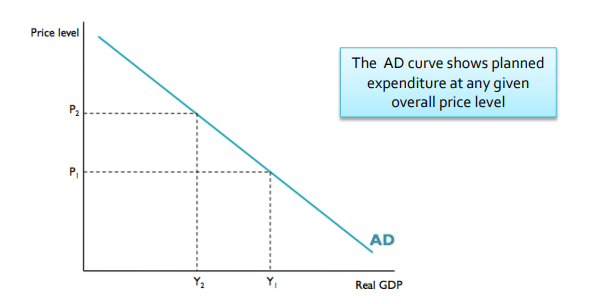

Aggregate Demand Curve

The AD Curve shows the relationship between the price level and the level of real expenditure in the economy.

The AD curve is downward sloping because:

- Exports and Imports: Lower prices in an economy increase global competitiveness, so exports increase and imports decrease. Therefore, net exports are higher at lower prices, so AD increases.

- Interest Rates: At higher price levels, interest rates are likely to be raised by the monetary authorities (to tackle inflation). Higher interest rates increases the cost of borrowing and increase the mortgage interest repayments, so investment will fall and savings increase (so consumption falls). Hence, AD decreases.

What are the main influences on consumer spending?

Consumption

Consumption is the total planned spending by households on goods and services.

Interest Rates

- Higher interest rates increase the cost of borrowing, and increase the benefit of saving. Therefore people borrow less and save more-‐ consumption falls.

- Higher interest rates increase the cost of mortgages (higher mortgage interest repayments), reducing the amount of money consumers have to spend on goods and services.

Consumer Confidence

- If consumers are confident, both in terms of job security and future income prospects, they will tend to spend more and also make large purchases which they can pay for in the future.

House Prices

As house prices increase, consumer spending increases (wealth effect).

- If house prices increase, consumers could go to their mortgage provider and request more mortgage equity release (i.e. take out a loan based on the increased wealth). This adds to the consumer’s disposable income, so consumption therefore increases.

- If house prices increase, consumers feel more confident and ‘wealthier’, and therefore save less and spend more.

What are the main influences on investment by firms?

Investment

Investment refers to expenditure by firms on capital stock.

Interest Rates

- To invest in capital stock, firms have to borrow money to finance the investments. Higher interest rates increase the cost of borrowing, and hence makes investment less attractive for firms.

Evaluative Point: However, many argue that interest elasticity of demand for investment is very low because investors are sometimes driven more by other factors, such as confidence in future sales patterns, actions of competitors, government incentives +regulations and the prospects for future interest rates. Moreover, not all investment has to be funded from borrowing-‐ some can be funded by past profits.

Confidence Levels

- If firms are confident about future sales, they will invest and try and improve their productive capacity so that they can increase supply in the future.

- Inflation creates uncertainty around future demand, and therefore discourages investment.

- If sales have recently been very good, future prospects look good so firms will tend to invest.

- However, if sales are slow, firms might also improve in certain capital resources to try and improve quality of products to boost sales.

Risk

- If the investment is a high risk one, a firm is less likely to take it on.

Influences of Government Regulation and Incentives

- If taxes fall, then firms will be more confident about future revenue and will therefore invest more.

- If the government gives a firm a subsidy to produce more of a certain product, then they will invest in capital stock so that they can produce more.

What are the main influences on government spending?

Government Spending

Government Spending refers to expenditure by local and central government.

Fiscal Position

Government spending depends on the fiscal position (see demand-‐side policies)

Unemployment Levels

With high unemployment, the government has to spend more on benefits.

What is the impact on the current account of the following factors?

Exports – Imports

Exports are goods and services purchased from the economy by foreigners

Imports are goods and services purchased by residents from abroad

A change in the exchange rate

If the exchange rate increases, the currency gets stronger and appreciates. If the exchange rate decreases, the currency gets weaker and depreciates.

A high exchange rate makes increases the value of the econony’s currency, making exports more expensive to foreigners and imports cheaper to residents. Therefore, imports increase and exports fall, so AD falls.Evaluative Point: The change in the exchange rate might have the opposite effects in the long and short run. In the short run, the PED for exports and imports tends to be low. This is because contracts for international trade deals are signed in advance. For example, a British importer of cars will agree a price for the delivery of 200 cars well in advance of delivery from Germany. If the pound gets stronger in the meanwhile, the original price will still be used, despite the cars now being cheaper for the British importer. Hence, in the short run there is little change to AD. However, if the pound continues to appreciate, the German exporter might look to sell elsewhere, and this would have an effect on AD in the long run. Also, PED tends to be low because many imports are goods with few substitutes, such as oil.

Changes in the state of the world economy

If there was a recession in the US, the UK economy would sell fewer exports to the US.

A boom in the stock market in the US would lead to more UK exports to the US due to wealth effects.

If inflation in the UK is high relative to the rest of the world, then net exports would decrease for the UK. If inflation is low relative to the rest of the world, then net exports would increase for the UK. Therefore, we can see that the global economy is a key determinant to the net exports of the UK.

Non-‐Price Factors

Non-‐price factors, such as quality and customer service, also affect net exports. For example, Germany cannot compete effectively on price, but it is the largest exporters of goods due to its high quality of design and manufacture.

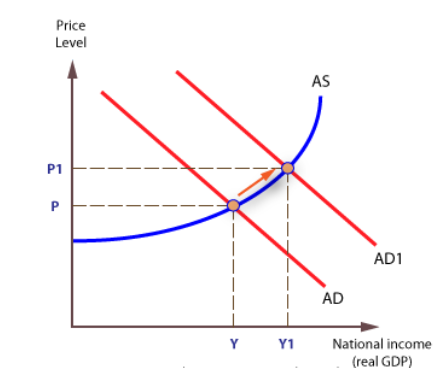

Aggregate Demand Curve-‐ Shifts

If C, I, G or X rise, the AD curve will shift to the right. The same happens if imports fall.

When we refer to C, I or any other component of AD changing, we are referring to a change in the level of this component, rather than the rate. In the UK, these components very rarely fall, but they rise at a slower rate during an economic slowdown. Therefore the AD curve will still shift to the right, but by increasingly smaller amounts.

Aggregate Demand (AD) refers to the total demand for goods and services in an economy. It is the sum of all spending by households, businesses, government, and foreign buyers.

The components of Aggregate Demand include consumer spending (C), investment spending (I), government spending (G), and net exports (NX), which is the difference between exports and imports.

Factors that influence Aggregate Demand include changes in consumer confidence and expectations, changes in interest rates, changes in government spending and taxation policies, and changes in foreign trade policies.

The Aggregate Demand curve shows the relationship between the price level and the total output of an economy, holding all other factors constant. It slopes downward, indicating that as the price level decreases, Aggregate Demand increases.

Changes in Aggregate Demand can have a significant impact on the overall economy. When Aggregate Demand increases, it can lead to higher levels of production, employment, and economic growth. However, if Aggregate Demand falls, it can lead to a decrease in economic activity and potentially lead to a recession.

There is a direct relationship between Aggregate Demand and inflation. As Aggregate Demand increases, so does the demand for goods and services, which can lead to higher prices and inflation. Conversely, if Aggregate Demand falls, it can lead to a decrease in prices and deflation.

Governments can use Aggregate Demand policies, such as monetary and fiscal policies, to manage the economy. For example, the government can increase spending or reduce taxes to increase Aggregate Demand and stimulate economic growth. Conversely, the government can reduce spending or increase taxes to reduce inflation and slow down economic growth.

Changes in the exchange rate can impact Aggregate Demand by affecting net exports. A weaker exchange rate can make exports more attractive and increase net exports, thus increasing Aggregate Demand. Conversely, a stronger exchange rate can make imports cheaper and reduce net exports, thus reducing Aggregate Demand.

Still got a question? Leave a comment

Leave a comment