Circular Flow of Income - A-Level Economics

National Income

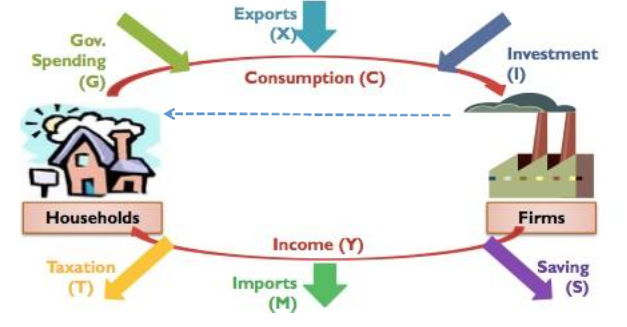

National Income can be shown as a Circular Flow

The circular flow of income shows the economy as a simple model where the households own all the factors of production-‐ land, labour, capital and enterprise-‐ and the firms produce goods.

Money moves from households to firms for the exchange of goods and services; and money moves back to households as payment for the use of the factors of production in the form of rent, wages, interest and profit.

Money circulates back and forth, and the more households spend the more firms produce.

What is the impact of injections and withdrawals on the circular flow?

Withdrawals

Withdrawals from the circular flow is money which leaves the flow, and does not flow back from households to firms.

- Savings-‐ money saved by households is not spent again so does not flow back to firms

- Taxation-‐ money paid by households to the government (this money is not spent on goods from firms)

- Imports-‐ spending by residents on goods and services made abroad.

Injections

Injections into the circular flow is consumption which does not come from households.

- Investment-‐ spending by firms on capital stock (productive resources such as factories) means more money flows to households in the form of wages, which increases spending and so on. Therefore, an increase in investment results in a rise in spending in the economy as well as an increase in the productive capacity of the economy.

- Government Spending-‐ spending by central or local government

- Exports-‐ spending by foreigners on goods and services made in the UK

Balance between Injections and Withdrawals

- If all the injections equal leakages, the economy is in equilibrium.

- If injections are greater than withdrawals, there will be economic growth.

- If withdrawals are greater than injections, there will be negative economic growth.

Income and Wealth

What is the likely correlation between income and wealth?

Wealth is the sum of all assets in an economy-‐ it is a stock concept.

Income is the amount of money earned during a period-‐ it is a flow concept.

- Countries with high levels of wealth tend to produce high levels of income. This is because the assets (wealth) can be used to produce an output which can produce an income.

- National income tends to be correlated with national wealth, but because wealth can be mismanaged, the correlation is not perfect.

- Wealth is a stock concept so does not have a direct impact on the circular flow of income, but changes in wealth are likely to have an effect on income and spending. For example, if you house becomes worth more, you will feel ‘richer’ and spend more, which will lead to more money going into the circular flow. This in turn increases income in the economy. This effect is called the wealth effect.

The wealth effect is the idea that when a household’s wealth increases, they feel more confident so spend more, allowing more money to enter the circular flow of income.

The Circular Flow of Income is a model used to represent the flow of money, goods, and services between households, businesses, and the government in an economy.

The Circular Flow of Income is made up of four components: households, businesses, the government, and the foreign sector.

Households provide labor to businesses in exchange for wages, salaries, and other forms of income. They also purchase goods and services from businesses, which creates revenue for businesses.

Businesses produce goods and services, which they sell to households and the government. They also pay wages and salaries to households, which creates income for households.

The government collects taxes from households and businesses and uses the revenue to provide goods and services to the public. The government also provides transfer payments, such as welfare and Social Security, to households.

The foreign sector includes trade with other countries. Businesses can export goods and services to foreign countries, which creates income for the domestic economy. The domestic economy can also import goods and services from foreign countries, which creates an outflow of income.

Leakage refers to any outflow of income from the Circular Flow of Income. Examples of leakage include savings, taxes, and imports.

Injection refers to any inflow of income into the Circular Flow of Income. Examples of injection include investment, government spending, and exports.

The Circular Flow of Income helps us understand how different parts of the economy are interconnected and how money, goods, and services flow between them. By understanding the Circular Flow of Income, we can better understand how changes in one part of the economy can affect other parts of the economy.

Real-world examples of the Circular Flow of Income include a family purchasing groceries from a local supermarket, a business exporting goods to a foreign country, and the government providing healthcare services to citizens.

Still got a question? Leave a comment

Leave a comment